If you have been watching Ghana’s momentum and wondering where the country is headed next, the Ghana economy 2026 outlook is a useful snapshot. Projections suggest Ghana could rank as Africa’s 8th biggest economy by nominal GDP (current US dollars) in 2026. Joy Business (MyJoyOnline) reports a projected Ghana nominal GDP of US$113.49 billion in 2026, up from about US$108.1 billion in 2025, alongside a projected growth rate of 4.8%.

For readers who want a multilateral benchmark, the International Monetary Fund (IMF) country page for Ghana lists 2026 projected Real GDP growth (% change): 4.8, 2026 projected Consumer Prices (% change): 9.9, and population: 35.698 million. This adds important context: headline GDP rankings are about total size, not income per person.

Important: All GDP ranking comparisons in this article are based on nominal GDP (current US dollars), not PPP and not GDP per capita.

Table of Contents

- What “8th biggest economy” means (and what it does not)

- Key figures for Ghana economy 2026 (IMF context)

- Top 10 African economies in 2026 (nominal GDP)

- What is driving Ghana’s growth outlook

- Inflation and GDP per capita context

- Historical GDP trend (2015 to 2026)

- AfCFTA and ECOWAS: why integration matters

- Risks and caveats to watch

- Why this matters for diaspora, investors, and planners

- Sources

What “8th biggest economy” means (and what it does not)

When media outlets say a country is one of the “biggest economies,” they are usually referencing nominal GDP in current US dollars. Nominal GDP measures total output converted at market exchange rates, which helps with cross-country comparison. However, it can move up or down because of inflation and currency changes, not only because more goods and services were produced.

It does not automatically mean: higher wages for everyone, lower living costs, or stronger household purchasing power. To understand day-to-day outcomes, it also helps to look at inflation, jobs, and income measures like GDP per capita.

Key figures for Ghana economy 2026 (IMF context)

Here are the headline numbers used throughout this Ghana economy 2026 guide, combining Joy Business reporting with IMF country-level indicators:

- Projected 2026 nominal GDP (current US$): US$113.49 billion (Joy Business, via MyJoyOnline).

- Estimated 2025 nominal GDP (current US$): about US$108.1 billion (Joy Business, via MyJoyOnline).

- Projected 2026 real GDP growth (% change): 4.8 (IMF Ghana country page).

- Projected 2026 consumer prices (% change): 9.9 (IMF Ghana country page).

- Population: 35.698 million (IMF Ghana country page).

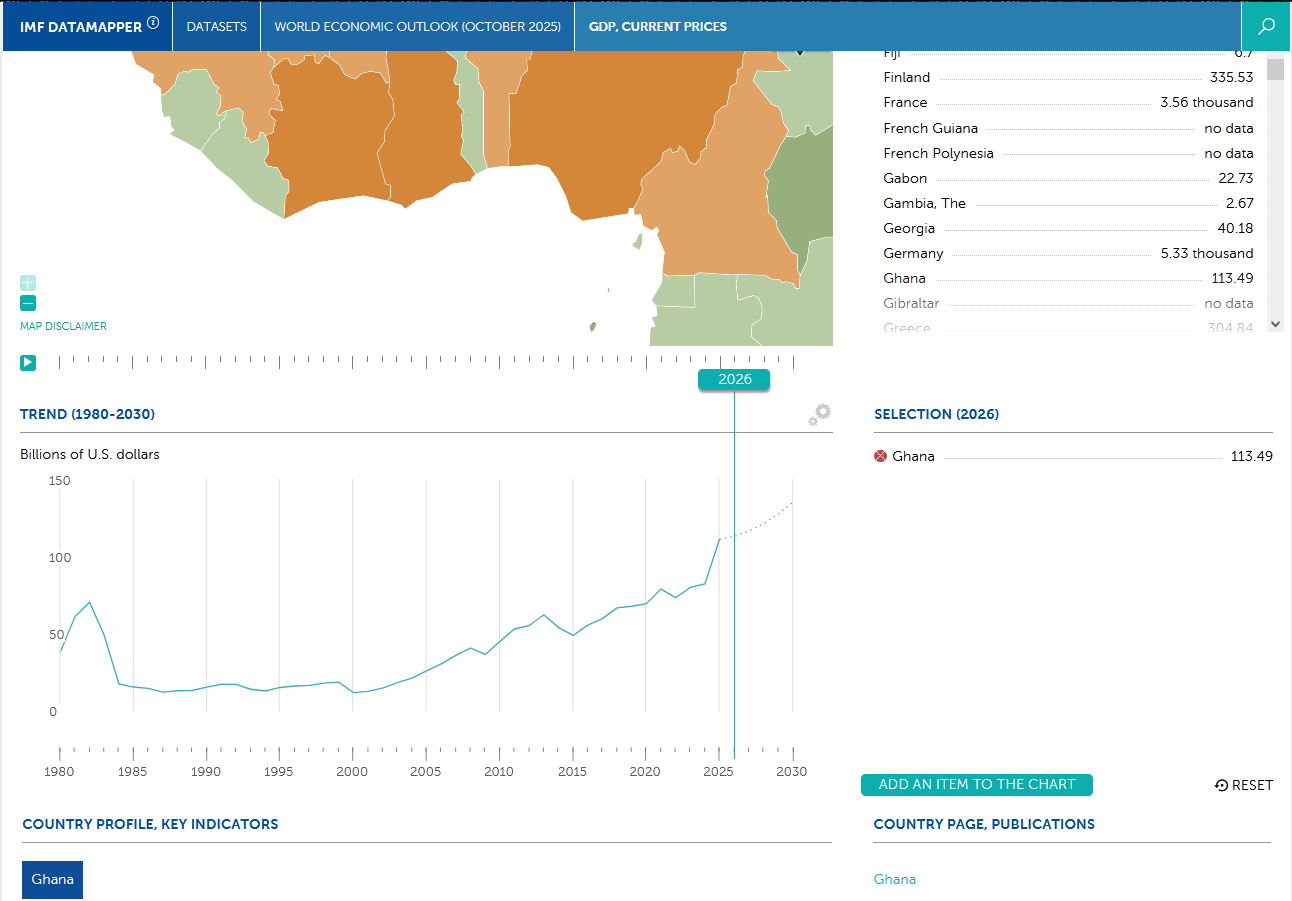

For readers who want to cross-check the nominal GDP line directly, the IMF World Economic Outlook DataMapper commonly lists it under GDP, current prices (Billions of U.S. dollars).

Top 10 African economies in 2026 (nominal GDP, current US dollars)

The table below restates the ranking described in the source material. Label: nominal GDP (current US dollars).

| Rank (2026) | Country | Nominal GDP (US$) |

|---|---|---|

| 1 | South Africa | ~443.64B |

| 2 | Egypt | ~399.51B |

| 3 | Nigeria | ~334.34B |

| 4 | Algeria | ~284.98B |

| 5 | Morocco | ~196.12B |

| 6 | Kenya | ~140.87B |

| 7 | Ethiopia | ~125.74B |

| 8 | Ghana | ~113.49B |

| 9 | Cote d’Ivoire | ~111.45B |

| 10 | Angola | ~109.86B |

What is driving Ghana’s growth outlook

1) Diversified economic composition (relative to peers)

Ghana’s economy is often described as relatively diversified within West Africa. Traditional export pillars like gold and cocoa remain important, while the oil and gas sector has grown in GDP and fiscal relevance. This mix can help stabilize earnings when commodity cycles move in different directions.

2) Infrastructure investment and lower logistics friction

Infrastructure improvements in roads, ports, and energy systems can reduce operating costs, shorten delivery times, and improve reliability for businesses. This matters for manufacturing, trade, and services expansion.

3) Services and industrial activity

Services (finance, telecoms, retail, professional services) and industrial activity (processing, construction, light manufacturing) can broaden the growth base beyond primary commodities.

Related on GhanaCitizenship.com:

Inside Ghana’s growing tech sector and

Ghana business opportunities for Black Americans.

Inflation and GDP per capita context (why the ranking needs nuance)

Inflation trajectory matters

Inflation can make nominal GDP rise even when real output grows more slowly. The IMF Ghana country dashboard lists 2026 projected consumer prices (% change): 9.9, which signals that prices remain a meaningful part of the macro story. The key takeaway is simple: nominal GDP reflects size, inflation affects purchasing power, and real growth reflects true output expansion.

GDP per capita (simple approximation)

Using the projected Ghana nominal GDP reported (US$113.49B) and the IMF population figure (35.698M), a rough 2026 nominal GDP per capita estimate would be around US$3,100 to US$3,200. This is an approximate calculation, not an official per-capita dataset line item, but it helps explain why “8th biggest economy” is not the same as “8th highest income.”

Per capita comparison table (top 10, fill from one dataset)

The table below provides a per-capita view for context. The values shown are projected nominal GDP per capita in current US dollars, with an illustrative conversion into Ghana cedi (GHS).

| Country | GDP per capita (2026, USD) | GDP per capita (2026, GHS) | Notes |

|---|---|---|---|

| South Africa | $7,200 – $7,500 | GHS 108,000 – 123,750 | Highest per capita among the top 10 large economies. |

| Egypt | $3,800 – $4,200 | GHS 57,000 – 69,300 | Large population moderates per capita despite high total GDP. |

| Nigeria | $1,500 – $1,800 | GHS 22,500 – 29,700 | Large population lowers per capita despite scale. |

| Algeria | $5,800 – $6,200 | GHS 87,000 – 102,300 | Hydrocarbon revenues influence per capita. |

| Morocco | $4,800 – $5,200 | GHS 72,000 – 85,800 | Diversified economy, mid-range per capita. |

| Kenya | $2,400 – $2,800 | GHS 36,000 – 46,200 | Fast growth, still mid/low per capita. |

| Ethiopia | $1,100 – $1,300 | GHS 16,500 – 21,450 | Large population, lower per capita. |

| Ghana | $3,100 – $3,300 | GHS 46,500 – 54,450 | Based on ~US$113B nominal GDP and ~35–36M population. |

| Cote d’Ivoire | $3,800 – $4,200 | GHS 57,000 – 69,300 | Close to Ghana in nominal scale. |

| Angola | $3,000 – $3,400 | GHS 45,000 – 56,100 | Oil exposure can raise per capita variability. |

Note: USD figures are projected 2026 nominal GDP per capita (current US dollars). GHS figures are converted using an illustrative exchange rate range of 1 USD = 15.00 – 16.50 GHS. For final publication, replace with the current Bank of Ghana reference rate and exact IMF WEO NGDPDPC values.

Historical GDP trend

AfCFTA and ECOWAS: why integration matters

AfCFTA (continental integration)

Ghana plays an institutional role in the African Continental Free Trade Area because the AfCFTA Secretariat is based in Accra. In practical terms, AfCFTA aims to reduce trade friction, expand market access, and improve cross-border business scaling. These effects are typically medium-term, and they work through trade costs, logistics efficiency, and services expansion rather than overnight GDP jumps.

ECOWAS (regional mobility and commerce)

For West Africa specifically, ECOWAS integration frameworks matter for movement of people and business across the region. Even when implementation is uneven, the policy direction supports lower friction for regional commerce, labor mobility, and cross-border enterprise.

Related on GhanaCitizenship.com:

Residency to Ghanaian citizenship timeline and

How to get Ghanaian citizenship (2025 guide).

Risks and caveats to watch (what could change the projection)

Projections can change, especially when nominal GDP is used for rankings. Key factors that can shift Ghana economy 2026 outcomes include:

- Exchange rate volatility: nominal GDP in US$ is sensitive to currency movements.

- Inflation persistence: higher inflation can distort nominal growth while hurting purchasing power.

- Commodity price swings: gold, cocoa, and oil price cycles affect exports and fiscal stability.

- Debt management and financing conditions: changes in debt sustainability perceptions can impact investment and stability.

- External shocks: global interest rates, trade disruptions, or regional instability can affect forecasts.

Why this matters for diaspora, investors, and planners

For people planning a move, starting a business, or investing, Ghana economy 2026 projections matter because they can signal:

- Potential expansion in market size and services depth

- Infrastructure and logistics improvements that reduce operating friction

- Regional positioning for West African trade and mobility

At the same time, GDP rankings alone are not a relocation plan. Practical decisions still come down to income expectations, living costs, safety, and your legal path for residency and citizenship.

Helpful next steps:

Ghana safety relocation guide,

US salary for living in Ghana, and

Documents needed for Ghana citizenship (US citizens).

Sources

- MyJoyOnline (Joy Business): Ghana to become Africa’s 8th biggest economy in 2026

- IMF: Ghana country page (At a Glance indicators)

- IMF WEO DataMapper: GDP, current prices (WEO)

- African Union: African Continental Free Trade Area (AfCFTA)

- AfCFTA Secretariat official site

- ECOWAS: Protocol relating to free movement of persons (PDF)

Compliance: All money transfer services must be licensed by the Bank of Ghana.